7 Biggest Stock Market Crashes Ever

Stock market crashes have often been tied to catastrophic events. There comes a time, however, when the crash becomes the event itself, the means of a disaster rather than the end thereof. Whatever their causes, stock market crashes have moulded world history. The following are some of the biggest crashes of all time, whose impact can still be felt in many ways today.

Black Friday (1869)

We know Black Friday as a day of wanton consumerism before Christmas, but there can only be one Black Friday in history. This day refers to the calamitous crash of September 24, 1869, which in retrospect was a classic case of corruption in the highest echelons of power, involving the family of no less than US President Ulysses Grant. The crash was orchestrated by speculators Jay “Mephistopheles of Wall Street” Gould and James Fisk, who spun a web of deceit that entailed the hoarding of the Union’s entire gold market. This sent the price of the yellow metal to atmospheric highs ($162 an ounce), gravely flattening stocks.

Paris Bourse crash (1882)

This crash, caused by a weakened l’Union Generale, signalled the worst economic crisis in 19th century France. At least some good came out of this: After the crash, Paul Gauguin moved from the finance business to answer his true calling in life.

Panic of 1907

It was 1906. San Francisco had just been levelled by an earthquake, and the federal government was raising vast amounts of aid to reconstruct the metropolis. Meanwhile, the Bank of England was hiking up interest rates to cover insurance claims. It did not help that the following year, a copper company attempted to corner stock while a New York City bond offering stalled. From hitting 103 points in January 1906, the Dow Jones Industrial Average, created only 10 years before, recorded only 53 points on November 15, 1907. Many banks and businesses were bankrupted, and it took the initiative of JP Morgan to turn the whole mess around. The government swore never again, and passed the Aldrich-Vreeland Act of 1908 and Federal Reserve Act of 1913, which created the Federal Reserve System.

Black Tuesday (1929)

America’s financial history can be pretty much divided into before the Great Depression and after. The line of demarcation was the Stock Market Crash of October 29, 1929, a day so infamous it was known simply as Black Tuesday. It marked the end of the Roaring Twenties, a decade of sustained economic growth that made many Americans so affluent. The resounding crash left many investors destitute; suicides from skyscrapers became commonplace. Hundreds of banks went down, countless people were left out of jobs—all these set the scene for the Great Depression. This is truly the crash by which all other crashes are measured. It was so severe that several federal agencies and social programs were established to foil an encore.

Black Monday (1987)

Oct. 19, 1987 will forever be etched in history as Black Monday, which witnessed the biggest one-day percentage slide ever. It was a fitting culmination to an era marked by hostile takeovers, buyouts, mergers, and overall greed. That day, the Dow slumped 508 points, i.e. a staggering 22.6 percent. If it were not for the Federal Reserve that had been in place since the Crash of 1929, the economy would surely have segued into another depression.

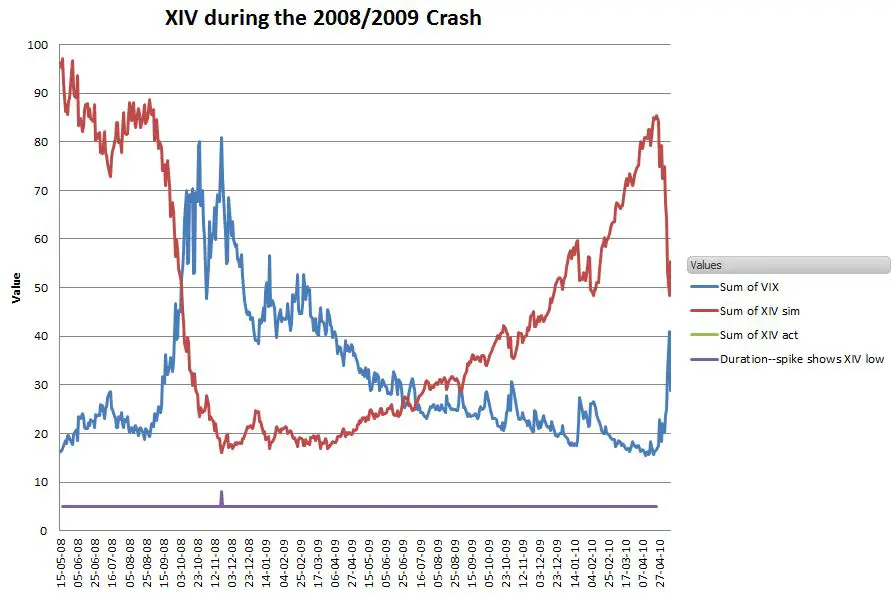

Crash of 2008

While not as vicious as the 1987 crash, the Dow slump of 2008 was pernicious enough to herald an era of financial ruin: The Great Recession. First, some context: America had been encapsulated in a subprime mortgage bubble for a good part of the 2000s. Even with these facts, Congress failed to pass the Troubled Asset Relief Program (TARP) bill in time to bail out the economy. In any event, on Sept. 29, 2008, the Dow saw a leviathan one-day index slide of 777 points. The collapse of Lehman Bros. is a lasting reminder of this odious day.

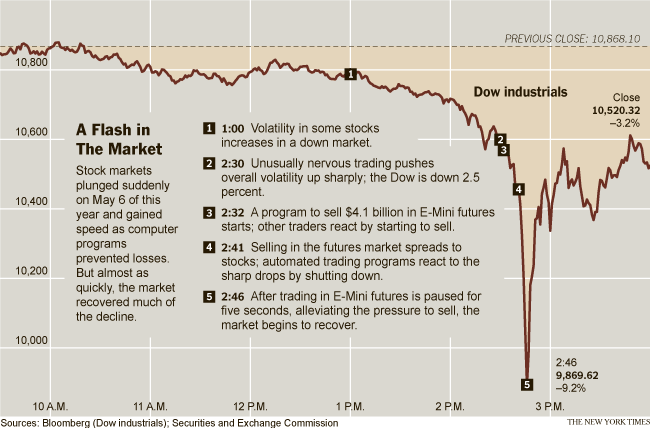

Flash Crash (2010)

Proof that the stock market has truly caught up with the times can be traced to 2010. This stock market crash was not caused by greedy financiers, mortgage bubbles, etc. In fact, it was not caused by any human hand at all. It was the result of a glitch in algorithmic programming that was responsible for offering share bids. The Dow fell by nearly 1,000 points in a span of 20 minutes. That half-hour of limbo reverberates to this day, and software engineers are still making sure that a problem of this scale will not happen again.

Proof that the stock market has truly caught up with the times can be traced to 2010. This stock market crash was not caused by greedy financiers, mortgage bubbles, etc. In fact, it was not caused by any human hand at all. It was the result of a glitch in algorithmic programming that was responsible for offering share bids. The Dow fell by nearly 1,000 points in a span of 20 minutes. That half-hour of limbo reverberates to this day, and software engineers are still making sure that a problem of this scale will not happen again.

When will the next crash happen?

No force on earth can ward off a crash, in the same way that earthquakes and cyclones are inevitable parts and parcels of human life. The best way to prevent something unstoppable is mitigation, i.e. a system of portfolio insurances that would blunt the effects of a crash as devastating as 1987 or 2008. Such insurances can compromise short-term profiteering however. The onus then is on federal agencies to create reforms that would pre-empt inordinate index slides.

All that said, crashes will happen again, and as this list shows, they seem to always fall on September, October, or November. So reader, beware.